Dutton's Tax Deduction on Interest for the First $650K of a Mortgage: What Does it Really Mean?

Spoiler: It’s Not What the Mortgage-Holding Public Ordered—But the Banks Will Be Stoked

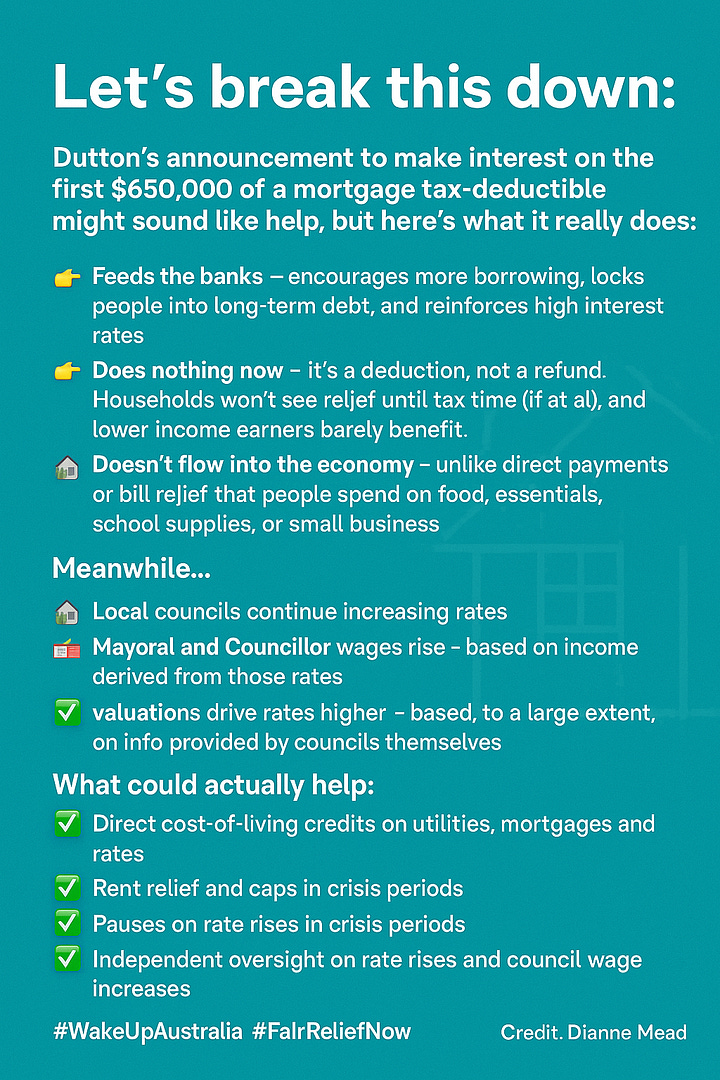

Let's break this down!

Dutton’s announcement to make interest on the first $650,000 of a mortgage tax-deductible might sound like help, but here’s what it really does:

Feeds the banks – encourages more borrowing, locks people into long-term debt, and reinforces high interest rates

Does nothing now – it’s a deduction, not a refund. Households won’t see relief until tax time (if at all), and lower income earners barely benefit

Doesn’t flow into the economy – unlike direct payments or bill relief that people spend on food, essentials, school supplies, or small business

Meanwhile...

Local councils continue increasing rates - and burning through your dollars

Mayoral and Councillor wages rise — based on income derived from those rates

Valuer General valuations keep going up, based to a large extent, on info provided by councils themselves

So where’s the checks and balances?

Where’s the community consultation on rising rates?

Where’s the relief for mortgage holders, home owners who have done the hard yards, renters alike who are barely keeping their heads above water?

What could actually help:

Direct cost-of-living credits on utilities, mortgages and rates

Rent relief and caps in crisis periods

Pauses on rate rises in crisis periods

Independent oversight on rate rises and council wage increases

Real-time feedback loops between the people and policy, not top-down handouts to banks and local bureaucracies

It’s time to wake up, Australia.

We’re being squeezed at every level — banks, councils, and a government playing middleman to keep the money flowing upward.

But what about us? What about the Aussie households doing it tough?

We do deserve better!

Let’s speak up, stand together, and demand policy that actually serves the people.

Less spin. More solutions. Policy should serve the people, not the powerful.

— Dianne

We need innovative, solution-oriented thinking — not the same top-down bandaids.

If renters receive relief, why not homeowners too?

🔹 Temporary halts or forgiveness on council rates during crisis periods

🔹 Rate relief credits similar to rent assistance — especially for pensioners, single parents, and working families

🔹 A statutory ban on councils taking legal action for unpaid rates during officially declared economic hardship periods

🔹 Clear guidelines and hardship protections for residents before councils escalate debt

This isn’t about handouts — it’s about keeping people housed, mentally well, and economically afloat during national or local hardship.

It’s time our policies reflected compassion and common sense — not just for economic stability, but to help reduce domestic violence, crime, and community breakdown that escalates when families are pushed to the brink.

Stability at home leads to stability in society.

🔗 Also related…

When Queensland Premier Steven Miles recently spoke on youth, it raised an important follow-up question: what about the women—especially mothers—supporting them?

For a deeper breakdown on how the experiences of women and youth are deeply interwoven, and how policy neglect in one area inevitably affects the other, read my related piece on systemic financial harm and intergenerational inequality:

👉 Addressing Systemic Economic Abuse: The Struggles of Youth and the Hidden Impact on Mature-Aged Women and Single Mothers

direct link coming– or simply go to:

DianneMead.Substack.com

Let’s Move from Hardship to Hope—with Purpose and Policy!

— Dianne

Economic hardship isn't limited to national downturns — it includes declared disaster zones: flood-affected regions, bushfire zones, drought-declared areas, and communities impacted by natural or public health crises. These are times when rates relief, not litigation, should be the norm.

Compassion-driven policies can prevent compounding trauma and displacement.

#WakeUpAustralia #FairReliefNow #CostOfLivingCrisis #FairGoMate #YouthMatters #SingleMothers #WelfareReform #Election2025